For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

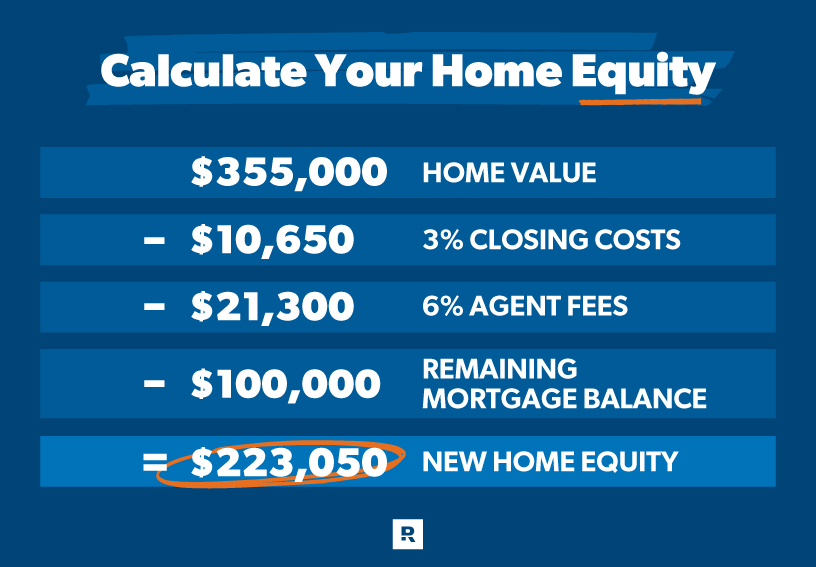

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

New Father Kicks Wife With Newborn Twins onto the Streets, Years Later He Begs Her for Help – Story of the Day

A minted father who is unwilling to spend money to raise his newborn twins asks his wife to give up one baby for adoption. He kicks her out with the babies when she refuses and knocks on her door for help five years later.

It was a cold, rainy night, and Angie cradled her newborn babies at the bus stop. “Where will we go? Jesus, please help us. Shelter us as we wait out this rough night,” she cried, wiping warm tear droplets off her babies’ faces. Angie had nowhere to go, and her parents had died long back.

Suddenly, she sensed something creeping behind her and was terrified. Angie mustered the courage to protect her babies from whatever it was. “It’s a dog!” she sighed.

Angie never imagined her life would turn topsy-turvy overnight. She never thought her husband Jake, who she trusted and loved throughout their marriage, would kick her out with their babies just a week after their birth…

For illustration purposes only | Source: Pixabay

“How I wish my mom were with me today…Sorry, mama, I should’ve listened to you and not rushed with my marriage with Jake,” sobbed Angie, thinking about her late mom.

“You can stay in this house as long as you agree to keep just one baby or leave if you want to keep both. Decide wisely, dear.”

Angie met Jake after graduation five years ago. He was a young, handsome man, and she thought he was the one. They fell for each other in what would turn into a fairytale love story, but with one exception—there was no ‘happily ever after’ in Angie’s case.

Problems sparked in the fourth year of their marriage when she told Jake she was pregnant.

“But darling, you know I’ve just started my business. We have postponed baby planning all these years, and I am not ready to be a father yet,” Jake was upset when Angie showed him the two pink lines on her pregnancy test kit.

Jake’s reluctance to be a father showed he was unprepared for responsibilities. Poor Angie was torn between his disapproval of having children and her desire to have as many as possible. But was Jake prepared to know Angie was pregnant with twins?

For illustration purposes only | Source: Pexels

“I am okay with having a baby…you get it? I mean, one baby is enough,” said Jake as Angie walked into the ward for scanning. “I pray that you don’t come out and tell me we are having twins,” he joked, his mouth curved into an ironic smile. Moments later, fate joked back at him.

Angie came out, distressed and worried. She was pale while she was supposed to be blushing and smiling.

“What is it?” he asked her, impatient for her reply. “What did the doctor say?”

Angie swallowed her fear and spoke out, partly guessing Jake’s reaction. “Our babies are fine,” she said.

“Alright…wait, what…babies?” he exclaimed.

The scan Angie took minutes ago gave her a glimpse at two tiny lives growing inside her. She was pregnant with twins, and Jake was not happy about that.

For illustration purposes only | Source: Pexels

Jake stormed to his car as Angie read his mind and pictured his frustrations. She was nervous and thought he had joked about having only one baby. But his reactions proved otherwise.

Jake grew distant from Angie day by day and focused only on making more money. She knew he was upset about having twins and assumed he would cool down with time. But it only worsened during her third trimester.

Angie was in the hospital, waiting for Jake to see their newborn twin baby girls. But he never showed up. He sent his maid and driver three days later to bring Angie and their babies home.

Jake did not want to get involved with his babies. He didn’t even welcome them home or hold them. He was unhappy and unprepared to be their father.

Angie returned home with her newborns that evening, knowing little about Jake’s condition. “We keep only one child and give the other up for adoption. If you are okay with it, we are a family. If not, you can leave the house with them,” he told Angie.

For illustration purposes only | Source: Pexels

At first, Angie thought Jake was kidding. He dragged her suitcase to the living room and placed it in front of her, indicating he was serious.

“I’m not ready to raise two children and burn a hole in my pocket. My business is fetching a lot of profits, and I need to focus on making more money…I don’t want to waste my time and wealth on raising two babies when I can easily raise just one,” he explained.

Angie was devastated. “They are our babies, Jake. How could you ask a mother to give up her baby? Are you out of your mind? Both my babies are our symbol of love,” she cried. But Jake was stubborn.

“My business has just started to flourish, and I don’t have the time to focus on family. I don’t want to waste my hard-earned money on two babies. You can stay in this house as long as you agree to keep just one baby or leave if you want to keep both. Decide wisely, dear,” he said, despite knowing Angie had nowhere to go.

For illustration purposes only | Source: Unsplash

The poor mother’s choice was obvious. She took her suitcase and left the house with the babies. Jake’s greed for his newfound riches blinded his devotion to family. He failed as a husband and a father. But it didn’t matter to him.

Angie snapped to her present and found herself still deserted at the bus stop, cradling her babies. “Where will I go? Please help me, Jesus,” she cried and was disrupted by an intense beam of light rays.

“Hello there, are you alright? It’s raining heavily. Would you like a ride, my dear?” an older woman called out to her from a taxi. Angie looked up and saw a nun. She wrapped her babies in her jacket and approached the car.

“Oh my, how adorable your babies are!” exclaimed the nun. “Get in. I’ll drop you. Where do you want to go?”

“I don’t know, Sister,” said Angie. “My path is dark, and I am lost. I don’t know which way to go. My babies and I were abandoned by someone dear to us.”

The nun understood Angie’s misery and immediately took her to the convent.

For illustration purposes only | Source: Unsplash

Angie and her daughters, Sophie and Marley, found a safe shelter to wait out the rough days of their lives. Angie taught in the school administered by the church. She also worked part-time in a restaurant, and two years later, she saved a good chunk of money to start her café.

Gradually, Angie was able to give her daughters a better life, though it could’ve been much better had their father been involved. Moreover, Angie did not regret her decision not wanting to divorce Jake. Deep in her heart, she hoped he would realize his mistake and come for them someday.

Five years passed, and Angie now had her own house. It was quite small yet comfortable. She spent the best years watching Sophia and Marley grow up.

There were times when Angie used to struggle without enough profits in business, but her faith and determination motivated her. She launched two more coffee shops in town, and gradually, her fortune grew. But in the other part of town, Jake’s business tanked.

He was drowned in debt, and everybody he sought financial help from refused to support him at the last minute. Jake knew how rich Angie was now and thought only she could help him.

For illustration purposes only | Source: Pixabay

“Hey, how are you?” Angie answered the door one day when she least expected to see Jake at the doorstep. “Come in!”

Jake vaguely smiled and immediately apologized to Angie. “Darling, I’m so sorry for abandoning you. My greed to earn more money cost me big. I am bankrupt, and it’s the best punishment I deserve for kicking you out with our babies. Please forgive me, and please help me.”

Angie now understood why Jake had come. She had learned about his loss in business but never thought he would visit her and apologize, let alone ask for help.

Jake saw a photo of Angie with their daughters and cried. “I’m sorry, sweethearts. Please forgive your daddy,” he said. Angie’s heart melted, and though she knew Jake had come crawling for help, she was willing to do it because she still loved him.

“But darling, I will not be able to repay such a huge amount of money. I will need time. I was such a cruel husband and a heartless father. Are you sure you want to help me?” he sobbed when Angie gave him a check worth the money he wanted.

“The night you kicked me out, I learned what greed is and how it can ruin relationships. And today, I learned what forgiveness is. What are we going to achieve by holding onto our past grudges? Nothing! Everyone makes mistakes, but as humans, we must learn to forgive one another,” said Angie.

Jake realized his mistake and promised to take Angie and their kids back once he sorted his business issues. He wanted to be a good father to his children and compensate for the heartbreak Angie endured all these years.

Leave a Reply