Barbra Streisand and her husband, James Brolin, are celebrating 26 years of marriage in the home where their love story truly came together. The journey to acquiring their dream home was anything but simple—it took them 11 years to finally buy it.

At 82, Barbra Streisand, the legendary performer, and her 83-year-old actor husband, James Brolin, have enjoyed many years of happiness in their beloved home. The couple, along with their dogs, have created countless memories there. Their dedication and perseverance paid off, making their home a symbol of their enduring love and commitment.

Barbra Streisand first laid eyes on the house when she was living nearby. At the time, she couldn’t make the purchase because her boyfriend didn’t like it, and she also wasn’t able to afford it.

Now, Barbra Streisand and James Brolin live in the dream home that took 11 years to buy. They recently celebrated their 26th wedding anniversary on July 1 in this special place. Streisand shared a sweet photo on Instagram, showing the couple in a side embrace. Her caption read, “28 years today since we met honey… and 26 years today since we married! Love you.

Their Maltese poodles, Scarlet, Violet, and Fanny, are clearly a cherished part of their family. Streisand’s Instagram posts of their birthdays must be adorable! It sounds like their home is filled with love and joy.

In 1984, while living on a ranch down the road, Barbra Streisand first laid eyes on her dream home. At the time, she wasn’t thrilled with her current house, so her real estate broker showed her a place closer to the ocean. This home would later become the one she and James Brolin would spend many cherished years in, despite the long journey to finally owning it.

Streisand noted that the house’s facade wasn’t particularly impressive, describing it as modern gray and somewhat like a “contraption.” However, upon entering, she was pleasantly surprised by its “rustic charm,” which won her over despite its outward appearance.

The Broadway star fell in love with the house right away and wanted to buy it. However, it wasn’t possible at that time, and she had to wait several more years before she could finally make it her home.

At that time, Streisand owned the ranch she had been staying on. Her manager advised her that she wouldn’t be able to afford the dream home until she sold the ranch.

Streisand also revealed that her boyfriend at the time thought the house was too close to the cliff where it was situated. She decided not to purchase it, but she admitted, “I was so forlorn when I found out that it was sold to someone else, and they had started renovating it.”

Streisand’s affection for the house didn’t diminish over time. In fact, she continued to dream about it and couldn’t shake the feeling of longing. She admitted that she had a deep emotional connection to the home she couldn’t buy.

However, some years later, her luck turned around when the couple who owned the house kept her in mind as they got ready to move.

Years later, Streisand’s luck changed. The couple who owned the house remembered her as they prepared to move out, and this gave her another chance at the dream home she had always wanted.

Barbra Streisand was so in love with her dream house that she bought a home one house away just to be close to it. She even became friends with the elderly couple living between her current home and the dream house.

When the couple moved away, Streisand bought their house too. She planned to combine both properties into one large house on the two-acre land.

Finally, fate was on her side. The couple who owned her dream home divorced and lowered the price. Streisand was able to buy the house in 1995 and was thrilled. She was relieved not to have to build a new house or deal with lots of details.

Since then, Streisand has turned her dream home into a beautiful place, celebrating its craftsmanship and making it a special part of her life for nearly 30 years.

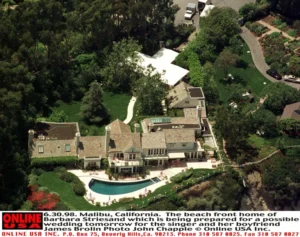

The house is set on a big piece of land with beautiful green lawns. An aerial view shows the spacious garden and the pool in front of the house, which faces the ocean. The driveway is located at the back of the house.

To design the interior of her home, Streisand looked at many books and drew inspiration from things she saw while traveling. She really enjoyed this process.

She also added streams to the landscape because she finds water very calming. Streisand wanted a barn because she loves how they are a key part of American culture. Inside her barn, she has hens that lay green eggs.

Streisand and Brolin met in 1996 when they were 54 and 56 years old. Both had children from previous marriages and blended their families together. They got married two years after they first met.

Now that they’ve been married for 26 years and their kids are grown and out of the house, Streisand and Brolin are enjoying a new phase in their lives: being grandparents.

Streisand and Brolin have grandchildren from their adult children, and they always welcome them to spend time in their loving home.

After Treat Williams’ untimely departure, Catherine Zeta-Jones and John Travolta lead heartfelt tributes to him

Actor Address Williams tragically passed away after a horrific motorcycle accident, and numerous celebs sent their condolences to his family via social media.

The 71-year-old calendar man passed away as a consequence of the party, according to a statement released by his agent Barry McPherson on Monday, June 13.

John Travolta, who reminisced their Broadway adventures in the musicals Grease and More Than Here, was among the first to pay their respects to the late actor.

He recalls, “Treat Williams and I started together in NYC by appearing in two Broadway productions, More than Below and Grease.”

“I’m really sorry, treat. You and your family are on my mind. You’ll be missed by us. Greetings, John.

The Phantom, a 1996 movie starring Williams and Catherine Zeta-Jones, was tweeted with the simple message “R.I.P. Dearest Handle Williams.” Zeta-Jones shared a still from the movie.

Kim Cattrall, an actress and mother of two who costarred with the late actor in the 1999 television movie 36 Hours to Die, tweeted, “I’m in shock!”

“Farewell, Pricey Ensure. My sympathies go out to Pam, Gille, Ellie, and the family. a fantastic actor and friend.

“Sad information, relax in peace, brother,” Sharon Stone tweeted beside a screenshot of a news article claiming his death.

Mark Hamill shared a picture of them from the established with the caption, “Just got the terrible news that the globe has missing @Rtreatwilliams.” Mark Hamill was an uncredited storm base warrior with him in The Empire Strikes Back (1980). Such a wonderful individual, such a skilled actor, and such a cherished close friend. It breaks my heart. #RIP_Pal.”

“The numerous instances we worked collectively was generally remarkable and I was usually enthusiastic for the next time,” stated Emily VanCamp, the actress who portrayed Williams’ co-star in the film Everwood, with a picture of the actor in his youth. I’m offering my best wishes to your family, Deal with. Go get it, my dear friend.

“Treat and I spent months filming As soon as On a Time in America in Rome,” said James Woods, his co-star in the epic criminal offense drama from 1984.

“A long shoot can make traveling very lonely, but his constant sense of humor and amazing sense of humor have been invaluable. I’m saddened by his passing because he was someone I truly appreciated. #TreatWilliams, Godspeed.

Billy Baldwin penned a lengthy tribute to the celebrity in which he extolled his qualities as a clever, skillful, charming, witty, successful, attractive, and kind person. “Heart of gold.”

“A terrible loss,” he continued. He fought tirelessly to improve the climate and advance social fairness. We won’t get to see you. Manage your leisure time peacefully.

Leave a Reply